Invest in the $6T Commercial Real Estate Market

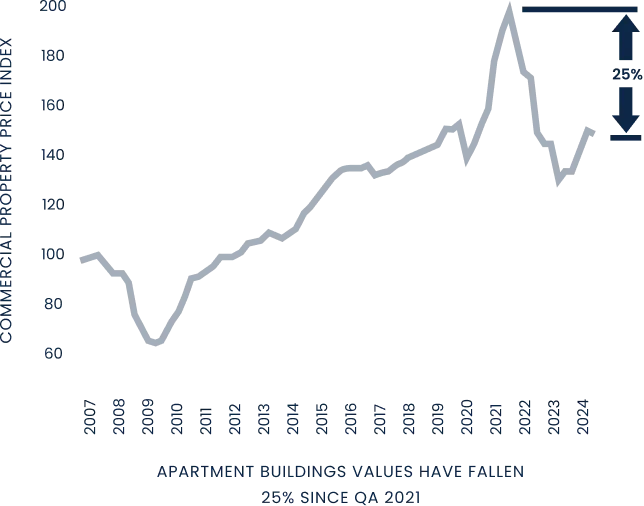

We’ve spent 20 years building our real estate company for this moment. A once-in-a-generation real estate market reset is creating the best window to buy properties since 20081. We’re giving you access with an investment opportunity designed to create potential returns of:

- Passive income from rental cash flow

- Special dividends generated from our real estate services

- Stock appreciation as we build even further

A SIMPLE WAY TO INVEST IN COMMERCIAL REAL ESTATE

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

Real Estate Income Made Accessible to Everyone

Get our investor deck delivered to your inbox and learn how AARE plans to buy commercial properties at up to 40% off—before the window closes.

Real Estate Returns Without the Volatility

.svg)

.svg)

.svg)

.svg)

.svg)

A 20+ Year Track Record in Real Estate

The Biggest Real Estate Reset Since 20081

.svg)

.svg)

.svg)

.svg)

.svg)

Diversification With Discipline

.svg)

.svg)

.svg)

.svg)

Bonus Shares for Early Investors

Your Investment Fuels the Next Stage of Growth

.svg)

Up to 75% of funds will go directly into income-producing commercial buildings.

.svg)

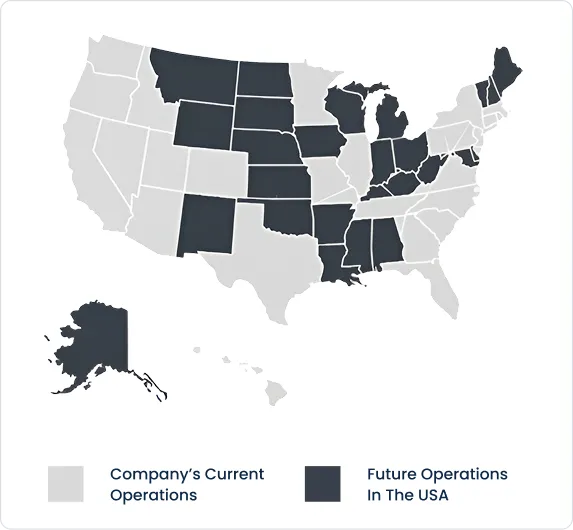

Already active in 26 states, we’re growing our portfolio in high-opportunity markets.

.svg)

With key legal, audit, and REIT compliance infrastructure already in place, we’re building toward a future public listing.

Purpose-Driven Profits

Beyond giving, we strive to create thriving communities. That’s why we partner with organizations like Marketplace Chaplains and Apartment Life to provide on-site resident care, host community-building events, and implement support systems that foster connection, well-being, and stability.

Get our investor deck delivered to your inbox and learn how AARE plans to buy commercial properties at up to 40% off—before the window closes.

Billion-Dollar Portfolios to Mission-Driven Businesses

Andrew has over 25 years of real estate experience. He has led AARE to over $2.75 billion in lifetime real estate transactions and pioneered its mission-driven business model, Generous Capitalism®. Andrew retains 88% ownership, demonstrating deep alignment with investors.

David brings 40+ years of commercial real estate expertise and has overseen more than $4 billion in multifamily real estate transactions. As founder of Continental Realty Group, he integrates faith-based values into high-level investment strategy.

Nick has over 20 years experience as an investor, asset manager, and broker. He has completed 1,000+ transactions, leased 4.5M square feet in space, and completed nearly $900M in volume. He has worked with major institutions like Equity Office Properties and Kilroy Realty on assets valued over $250M. He leads the investment team at AARE and is charged with selecting the best performing investments.

With a J.D. and LL.M. in Taxation, Chuck brings over 30 years of multifamily investment and development experience. He helps guide AARE’s purpose driven strategy, while also managing a family real estate company with nationwide holdings.

Clark has over 12 years of finance experience and has worked with AARE for 5 years. He oversees capital planning, financial modeling, and investor reporting.

Tiffany brings 13 years of real estate operations experience and has been with AARE for 8 years. She oversees compliance, internal systems, and HR for the expanding national team.

What You Need to Know

What kind of shares are you issuing?

Class A Common Shares

Where can I find the company’s SEC filings?

All of our regulatory filings , including financial reports, can be found here.

How much are you raising?

Up to $5,000,000 in our currently active Reg CF offering (now open for investments) and up to $72,082,500 in our forthcoming Reg A offering which was filed with the SEC on 9/25/25. Due to the government shutdown on 10/1/25, the Reg A filing has not yet been reviewed or qualified. We will update investors when we launch the Reg A offering once the government shutdown ends and the SEC responds to our filing.

How will I get a return on my investment?

Investing in early stage companies is risky and there is no guarantee you will get a return on your investment. However, an exit opens up the opportunity where you could convert your shares into cash or a more liquid asset. Exits include going public, getting acquired by a larger company, or our company buying back shares. If the value of our company grows, then you have a higher potential of making a profit on your investment during one of these exits. With that said, AARE's growth strategy directly links to its income generation and shareholder returns. Investors can see returns on AARE stock in five main ways:

• Appreciation of Real Estate Interests: An increase in the value of our real estate property interests.

• Special Dividends from Capital Events: Special dividends are declared when properties are refinanced or sold, and capital is returned.

• Dividend Income from Rents: Cash flow from rents provides dividend income, typically quarterly, offering a yield on the current stock price. We aim to transition to monthly dividend payments as soon as possible.

• Stock Price Appreciation: The stock price can appreciate due to public demand.

• Special Dividends from Real Estate Services: Our integrated real estate services divisions can generate special dividends upon achieving net income.

When will I receive my shares?

Shares will be distributed after the investment funds clear. This typically takes around 30 days after the investment.

Are there higher fees if you invest via credit card vs. ACH?

No, costs are the same, regardless of how you invest.

Why invest in startups?

Regulation CF allows investors to invest in startups and early-growth companies. This is different from helping a company raise money on Kickstarter; with Regulation CF Offerings, you aren’t buying products or merchandise - you are buying a piece of a company and helping it grow.

How much can I invest?

Accredited investors can invest as much as they want. But if you are NOT an accredited investor, your investment limit depends on either your annual income or net worth, whichever is greater. If the number is less than $124,000, you can only invest 5% of it. If both are greater than $124,000 then your investment limit is 10%.

How do I calculate my net worth?

To calculate your net worth, just add up all of your assets and subtract all of your liabilities (excluding the value of the person’s primary residence). The resulting sum is your net worth.

What are the tax implications of an equity crowdfunding investment?

We cannot give tax advice, and we encourage you to talk with your accountant or tax advisor before making an investment.

Who can invest in a Regulation CF Offering?

Individuals over 18 years of age can invest.

What do I need to know about early-stage investing? Are these investments risky?

There will always be some risk involved when investing in a startup or small business. And the earlier you get in the more risk that is usually present. If a young company goes out of business, your ownership interest could lose all value. You may have limited voting power to direct the company due to dilution over time. You may also have to wait about five to seven years (if ever) for an exit via acquisition, IPO, etc. Because early-stage companies are still in the process of perfecting their products, services, and business model, nothing is guaranteed. That’s why startups should only be part of a more balanced, overall investment portfolio.

When will I get my investment back?

The Common Stock (the "Shares") of [company name] (the "Company") are not publicly-traded. As a result, the shares cannot be easily traded or sold. As an investor in a private company, you typically look to receive a return on your investment under the following scenarios: The Company gets acquired by another company. The Company goes public (makes an initial public offering). In those instances, you receive your pro-rata share of the distributions that occur, in the case of acquisition, or you can sell your shares on an exchange. These are both considered long-term exits, taking approximately 5-10 years (and often longer) to see the possibility for an exit. It can sometimes take years to build companies. Sometimes there will not be any return, as a result of business failure.

Can I sell my shares?

Shares sold via Regulation Crowdfunding offerings have a one-year lockup period before those shares can be sold under certain conditions. The exceptions are sales to:

(i) to the Company;

(ii) to an “accredited investor” within the meaning of Rule 501 of Regulation D under the Securities Act;

(iii) as part of an offering registered under the Securities Act with the SEC; or

(iv) to a member of the Investor’s family or the equivalent, to a trust controlled by the Investor, to a trust created for the benefit of a member of the family of the Investor or equivalent, or in connection with the death or divorce of the Investor or other similar circumstance.

Exceptions to limitations on selling shares during the one-year lockup period:

In the event of death, divorce, or similar circumstance, shares can be transferred to:

The company that issued the securitiesAn accredited investorA family member (child, stepchild, grandchild, parent, stepparent, grandparent, spouse or equivalent, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law, including adoptive relationships)

What happens if a company does not reach their funding target?

If a company does not reach their minimum funding target, all funds will be returned to the investors after the close of the offering.

How can I learn more about a company's offering?

All available disclosure information can be found on the landing pages for our Regulation Crowdfunding offering.

What if I change my mind about investing?

You can cancel your investment at any time, for any reason, until 48 hours prior to a closing occurring. If you’ve already funded your investment and your funds are in escrow, your funds will be promptly refunded to you upon cancellation. To submit a request to cancel your investment please email: info@dealmakersecurities.com

How do I keep up with how the company is doing?

At a minimum, the company will be filing with the SEC and posting on it’s website an annual report, along with certified financial statements. Those should be available 120 days after the fiscal year end. If the company meets a reporting exception, or eventually has to file more reported information to the SEC, the reporting described above may end. If these reports end, you may not continually have current financial information about the company.

What relationship does the company have with DealMaker Securities?

DealMaker Securities is serving as the intermediary for this offering. Once an offering ends, there is no guarantee that DealMaker Securities will have a relationship with the company. The company may continue its relationship with DealMaker Securities for additional offerings in the future. DealMaker Securities’ affiliates may also provide ongoing services to the company. There is no guarantee any services will continue after the offering ends.

How will I (the Investor) make money?

AARE's growth strategy directly links to its income generation and shareholder returns. Investors can see returns on AARE stock in five main ways:

• Appreciation of Real Estate Interests: An increase in the value of our real estate property interests.

• Special Dividends from Capital Events: Special dividends are declared when properties are refinanced or sold, and capital is returned.

• Dividend Income from Rents: Cash flow from rents provides dividend income, typically quarterly, offering a yield on the current stock price. We aim to transition to monthly dividend payments as soon as possible.

• Stock Price Appreciation: The stock price can appreciate due to public demand.

• Special Dividends from Real Estate Services: Our integrated real estate services divisions can generate special dividends upon achieving net income.

How do I know people will invest in real estate and use your services?

We have proven demand and traction that includes:

• Nationwide Expansion: AARE has expanded from California to 26 states in the last few years, with 14 of those states already producing revenue, demonstrating market acceptance for its business model and culture.

• Successful Fundraising History: Prior to this round of financing, without any digital ad spend or media placement, AARE has raised $3 million by word of mouth, attracting over 250 investors. The average investment of approximately $15,000 is more than 10x higher than the average for other crowdfunding platforms, indicating strong investor confidence across different investment levels.

Are there more opportunities ahead?

Yes. We anticipate a substantial increase in investment opportunities over the next 3-5 years, driven by the significant volume of maturing debt. This presents a multi-billion dollar chance to acquire commercial properties at a discount, potentially even below replacement value. Further details, including charts, are available in the pitch deck.

Why didn't a bigger company do this already?

A few years ago, private syndications and public REITs acquired numerous assets at the market's peak. Now, they are compelled to sell due to high interest rates preventing loan refinancing, underwater portfolios, and an inability to purchase new assets because of redemption requests. We capitalize on these forced sales by acting as buyers. Moreover, most large, nationwide brokerage companies are franchises lacking dedicated investment divisions, deep knowledge of public markets, REIT compliance law, and the necessary nationwide network to effectively pursue this opportunity.

How do you plan to use the proceeds from this funding round?

Proceeds from this growth round will be primarily allocated to investments in income-producing commercial real estate assets. Secondarily, these funds will be used for general working capital, hiring management and administrative staff to oversee our investment operations, and preparing for and electing taxation as a Real Estate Investment Trust (REIT).

What is the current valuation of the Company?

We’ve set our pre-money valuation for this round at approximately $39 million. This share price reflects a careful analysis of financial modeling, the effect of dilution on future dividends, our company’s performance, and significant market opportunities ahead, all of which position us strongly for sustained long-term growth.

Why Should I Invest?

Invest with us if you're looking to diversify your portfolio with income-generating commercial real estate assets, but lack the substantial capital or management expertise. AARE offers an accessible entry point to own significant commercial properties, while we handle all management and oversight.

How long are you expecting the company to operate before needing another round?

After this round, we will have sufficient operational capital for an extended period. However, we plan to raise future rounds to invest more capital into income-producing real estate properties as the market cycle progresses. Should the market experience a major downturn, we will raise additional capital to leverage potential discounts.

What is the exit plan for the company?

Our core strategy centers on building a long term valuable and successful company by developing income-producing assets and expanding our service operations. This approach allows us to return capital to shareholders through dividends and offers significant capital growth appreciation. While exit opportunities such as an acquisition or IPO may naturally arise, our primary focus remains on successful execution of our plan. Given this strategy and favorable market conditions, investors are encouraged to hold their positions throughout the market cycle, facilitating full market recovery into and beyond the subsequent economic expansion.

What types of real estate are you currently focused on?

We are focused on multifamily followed by retail, industrial and office. Right now we find the most attractive discounts and upside for returns in the multifamily space.

How many investors do you have already?

We have over 250 shareholders (as of the beginning of this offering).

Will you be paying out dividends to investors?

We plan to invest a significant portion of the proceeds from this offering into income-producing commercial properties and elect to become a real estate investment trust (REIT). Therefore, we plan to issue dividends per IRS guidelines in the foreseeable future.

What’s the Company's core business?

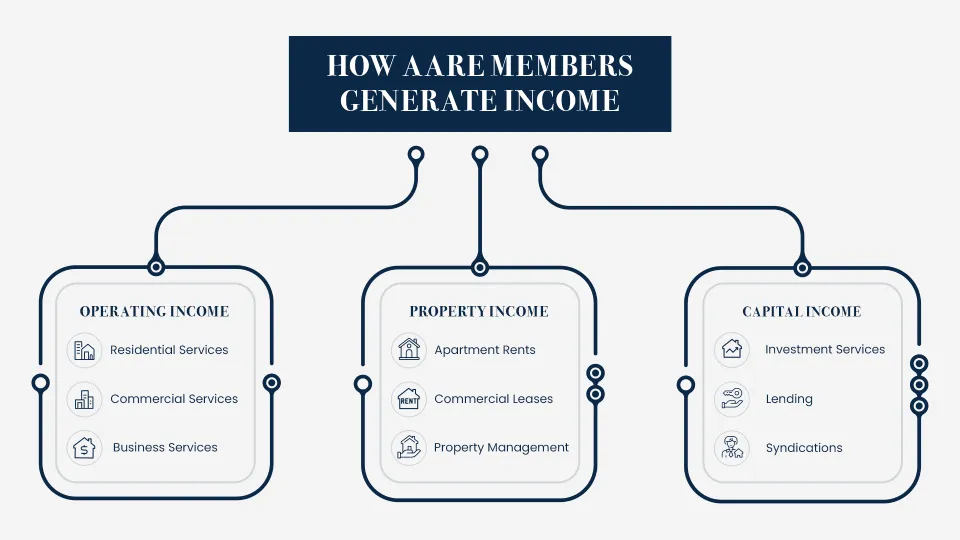

AARE's core business and revenue streams include:

• Residential and Commercial Sales & Leasing Commissions: Earnings from representing buyers and sellers in residential or commercial property transactions.

• Property Management Fees: Fees charged for managing and maintaining properties.

• Financing Services: Revenue generated from originating loans.

• Business Opportunity Sales: Revenue generated from representing buyers and sellers in business sale transactions.

• Syndications: Revenue generated from managing private real estate syndications.

• Forthcoming REIT: Earning income from the income producing properties we will purchase from the proceeds of this offering which will be distributed as dividends.

Where are your headquarters located?

San Diego, California

How many employees does your Company have?

~300 members composed of real estate professionals, full-time and part-time employees as well as independent contractors.

When will the Company expand into additional markets and which ones?

We are continuing to expand our footprint across the United States. Currently, we operate in 26 strategic states, which collectively account for 80% of America's transaction volume. Future plans involve expanding into the remaining 24 states, primarily in the Midwest, which represent the other 20% of transaction volume and investment opportunities, as financial resources become available. We are specifically targeting growth within the Sunbelt region of America, focusing on identified market areas within states where we already hold licenses.

Do you plan to expand internationally?

Yes. AARE boasts a diverse team of real estate professionals, many with international experience, who collectively speak over 20 languages. The company has identified more than 30 international markets for future expansion.

Can you share the roadmap for the next 4-5 years and when you expect to become profitable?

Our ambitious five-year roadmap outlines five key milestones crucial to realizing our long-term vision:

• Global Brand Establishment: We aim to build a global brand by effectively communicating AARE's mission, vision, and values worldwide. This involves continuously refining our message and voice to resonate culturally with a diverse audience seeking a reliable platform for their essential real estate services in a rapidly evolving and often divisive global landscape.

• Pioneering Generous Capitalism®: We are committed to demonstrating that faith-based principles from the Bible, when applied to corporate business practices at the highest level (including publicly traded companies), can foster love, create opportunities, address social challenges, unite communities, reduce wealth disparities, and, most importantly, honor God.

• Market Share Expansion: We will achieve market share growth by attracting and retaining top-tier investment managers, residential and commercial real estate agents, business brokers, loan officers, and property managers. Our focus will be on the 26 states where we are currently licensed, which collectively account for approximately 80% of the annual US transaction volume.

• Expanded Reach: We plan to extend our operations to all 50 US states and international territories, including the 24 US states where we are not yet licensed. This expansion will involve replicating AARE's successful methods and systems.

• Diversified Offerings and Revenue: We will broaden our service and investment offerings (verticals) and diversify our revenue streams, prioritizing recurring revenue. This includes developing a real estate investment trust (REIT) with assets under management, expanding our syndication and property management division, and in the future, adding insurance and other financial services.

What intellectual property (IP) do you have?

In addition to several branding trademarks, we hold the trademarks and rights to three registered and copyrighted media assets: Real Cash Flow®, Real Estate Insight®, and Top Dollar TV®. These media platforms represent significant investment and R&D over the years, enabling us to expand our reach to our target market. Our management developed these media properties in house and continue to scale them out to the public.

What does your path to profitability look like?

AARE's core operations are already approaching the breakeven point. The company maintains low overhead and a minimal burn rate compared to others at a similar stage, despite incurring occasional one-time expenses typical of a developing public company. This efficiency is attributed to the founder's 17-year single-shareholder investment, which built significant intrinsic value. Upon completion of the current funding round, and assuming a substantial portion of the target raise is met, the invested capital will be allocated towards acquiring income-producing properties rather than operational expenses or a high burn rate often seen in startups. This strategy is expected to lead to profitability and dividend distribution.

Who are your competitors? What are your advantages against them?

We differentiate ourselves from competitors, which include real estate brokerages, private syndications, and public REITs. There is no direct competitor that offers the full spectrum of our services and investment opportunities in a single platform, making us truly unique. Our competitive advantages include:

• Integrated Business Model: AARE uniquely combines an emerging growth real estate services company with the benefits of a REIT under one umbrella, a groundbreaking approach.

• Experienced Management Team: The executive team has an average of 20+ years of industry experience, with the CEO having 26 years and successfully navigating three market cycles. They possess deep market knowledge and nationwide licensing.

• Acquisition Deal Flow: AARE's extensive broker network across multiple states provides access to off-market deals and motivated sellers.

• Generous Capitalism®: The commitment to dedicating up to 20% of net profits to charity (10% cash, 10% client credits/in-kind) appeals to investors seeking financial, social, spiritual, and humanitarian benefits. This model aims to create a blueprint for future generations and addresses a generational shift demanding socially responsible businesses.

• Equity Compensation Plan: A unique equity compensation plan for real estate professionals is a powerful tool for recruitment and retention, aligning internal stakeholders with company growth.

• Vertical Integration: AARE's comprehensive suite of services (sales, leasing, property management, lending, business opportunities, syndication) allows for operational excellence and enhanced asset value.

Who is the main audience target for your services?

Real estate professionals, homeowners, commercial investors, business owners and buyers, sellers and tenants of real property.

Are you looking to partner with other companies?

Yes. We frequently partner with other companies and real estate operators. National partnerships are underway with universities and investment networks to scale our plans.

What have been the main challenges in developing your service/product and how have they been mitigated?

Although high interest rates and low inventory have impacted our service operations, they are poised to positively influence our investment operations. This further demonstrates how our diversification strategy enables us to thrive while others in our industry face challenges. Operationally, our primary challenges have involved building a robust, scalable platform to integrate diverse real estate services and manage a growing portfolio, alongside navigating varied regulatory landscapes across multiple states. We've mitigated these by aligning with the best-in-class technology partners and legal expertise, and by building a highly experienced team with deep market knowledge, a successful track record and nationwide licensing.

What is the latest business update for AARE?

In the past five years alone, the company has generated over $40 million in revenue and facilitated more than $1.5 billion in real estate sales transactions, generating income in 14 states as their expansion continues nationwide. Beyond their US expansion to 25 states, AARE is positioned for international growth. In the first half of 2025, the company achieved over 20% year over year revenue growth and hit a significant milestone of becoming EBITDA positive.

How do I invest in AARE?

To invest, complete the investment form at invest.aare.com. The steps are:

• Click the Invest Now button and fill in the contact information.

• Enter your desired investment amount.

• Provide contact information and submit your funds.

• If additional documentation is required, DealMaker or the AARE team will request it.

• Once funds are received and documentation approved, AARE will countersign your agreement to finalize your investment. You will receive an email with your countersigned subscription agreement.

• Allow a few days for your shares to appear in the online system.

Who can invest?

This offering is open to both accredited and non-accredited investors within the U.S. There is a minimum investment of $1,036, with no maximum.

Am I eligible to invest?

AARE is offering shares through Regulation A. As per SEC guidelines, non-accredited investors can invest in Regulation A but are limited to no more than 10% of their annual income or net worth.

What payment types are accepted?

You can invest using a credit card, wire, or ACH. Please note that clearing times vary by payment type. If using a credit card, ensure your investment amount is within your credit limit and that your credit card company permits the purchase of securities.

What is the minimum investment?

The minimum investment for the current Regulation A offering is $1,036. We cannot accept less than this amount.

What is the maximum I can invest?

There is no maximum investment amount if you are an accredited investor, however, if you are a non-accredited investor you can only invest up to 10% of your net worth or annual income, whichever is greater.

Can international residents invest in AARE?

Yes, AARE accepts investments from most countries where the investor can verify the legality of the investment under their country's laws. Certain countries are blocked due to their inclusion on the OFAC sanctions list (e.g., Russia, Belarus). This list is updated frequently, so it's important to check the latest version. For further questions, contact our investment team.

Where can I view my shares?

Once your investment is finalized (you've received your subscription agreement), you can log in to the DealMaker Transfer Agent online portal to view your shares. Please allow 30 days for your shares to be reflected in the portal. Use the email address you used for the investment to log in. Bonus shares will also appear in the portal once the investment is posted.

Where can I find more information about AARE?

For more information, please view our latest SEC filings page on the EDGAR system or click here.

Is there a direct number for the AARE Investor Relations Team?

For the quickest response, email invest@aare.com. Alternatively, you can call 888-322-4368.

On what platforms are AARE investment opportunities available?

Investments can be made on the AARE website, which links to DealMaker, the broker-dealer for our offering. You will create a DealMaker account to complete your investment, track its progress, and download your agreement once finalized.

When is the last day to buy shares?

The investment offering will close once it is fully subscribed, as there will be no more shares available under that offering statement.

What is the initial projected return on investment (ROI)?

As a high-growth startup, any projections on potential returns would be highly speculative. Therefore, we are not providing any forward projections.

Does AARE plan an IPO, and if so, when?

AARE plans to become tradable on the stock market through an IPO, SPAC, or Direct Listing, but an exact timeframe cannot be provided at this moment. We will prioritize what is best for the company and its shareholders, and we are actively working towards becoming a publicly traded company.

What happens to my shares if AARE goes public?

If AARE goes public, existing shareholders will be able to transfer their shares to a public market brokerage firm. At this time, it is unknown if there will be lock-up periods or restrictions for existing shareholders.

What is a Transfer Agent, and who is AARE's Transfer Agent?

A transfer agent maintains third-party records of investor holdings over time and facilitates private share transfers (with AARE's ultimate approval). AARE's current transfer agent for this offering and our Class A Common Shares is DealMaker Transfer Agent. You can contact them at info@dealmaker.tech. If you purchased shares in our previous offering prior to the summer of 2025, AARE used "Equiniti" (formerly American Stock Transfer or AST) for our Class B Common Shares. Equiniti can be contacted at 1-800-937-5449. All investments are Book Entry, meaning shares are digitally transferred without physical certificates.

What am I investing in?

You are investing in Class A Common Stock of AARE. As a shareholder, you own a part of the company and stand to gain as the company's value increases, potentially through an IPO or acquisition. Returns are tied to AARE's financial performance, including revenue from residential and commercial sales, property management, investments, and financing services. AARE's success could lead to an increase in your share value, offering potential for profit during or after a liquidity event like an IPO or acquisition.