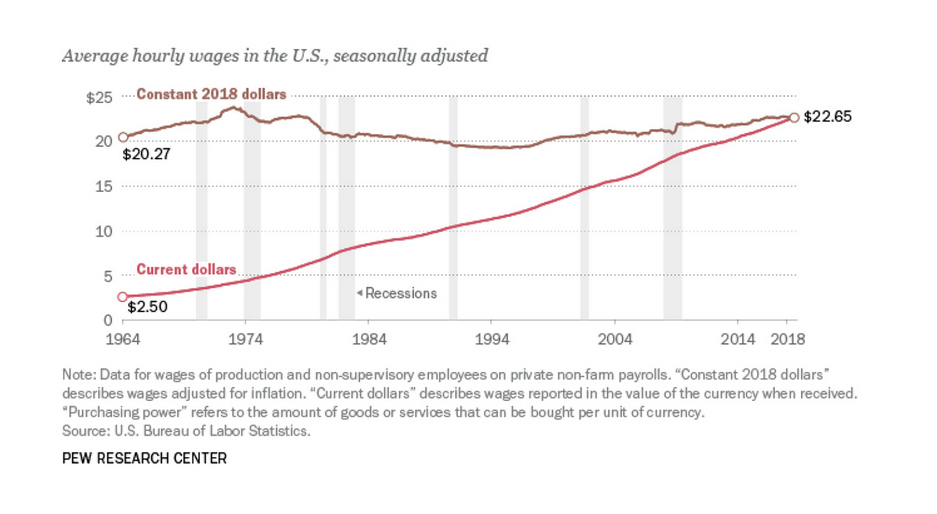

Over the last 30 years, wage growth has significantly lagged behind the rise in asset prices, particularly in the housing market. In the 1980s, the average cost of a house in the U.S. was around three to four times the median household income. By 2022, this ratio had increased to nearly six times the median household income (Visual Capitalist) (Pew Research Center).

Key Factors

- Home Price Surge: Between 2010 and 2022, home prices in the U.S. increased by 74%, while average wages only rose by 54% during the same period. This discrepancy is even more pronounced in certain regions. For instance, home prices in Nevada rose by 162% compared to a 47% increase in wages (USAFacts).

- Stagnant Real Wages: Despite nominal wage increases, real wages (adjusted for inflation) have barely budged since the late 1970s. For many workers, especially those in the lower income brackets, purchasing power has not improved significantly, contributing to a growing affordability crisis in housing (Pew Research Center).

- Economic Cycles: The real estate market is inherently cyclical, influenced by broader economic conditions such as interest rates, inflation, and job markets. In recent cycles, particularly post-2008 and during the pandemic, housing prices have surged due to low interest rates and high demand, further widening the gap between asset prices and wages (LongTermTrends) (Visual Capitalist).

Impact on Affordability

The growing disparity between wages and asset prices has led to a situation where many Americans are unable to afford homes. High home prices relative to income mean that a larger portion of household budgets must be allocated to housing, leaving less for other expenses. This also stifles economic mobility, as people may be reluctant to move for better job opportunities due to high housing costs (USAFacts).

Forward-Thinking Strategies

For real estate brokerages, navigating this environment requires innovative approaches:

- Promoting Affordable Housing: Advocate for and invest in affordable housing projects to cater to a broader segment of the market.

- Leveraging Technology: Use data analytics to identify undervalued markets and help clients make informed decisions.

- Adapting to Market Conditions: Provide flexible financing options and educate clients about the benefits of different mortgage products.

- Sustainable Investments: Encourage investments in energy-efficient and sustainable properties, which can offer long-term cost savings and appeal to environmentally conscious buyers.